Selling A Home to A Real Estate Investor

Has a real estate investor approached you about buying your home? Maybe you have reached out to them? If you want to sell your home quickly, the selling house for cash option could seem attractive.

The chance to bypass the normal selling process has many advantages. We review the issues involved in selling your home to a cash investor, so you are in a better position to decide if it is right for you.

A cash buyer will normally fall into one of three groups:

iBuyers

Have you wondered what the term iBuyer meant? A relatively new entrant to the market, iBuyers are companies that use sales data to make what they believe is a fair offer on your property. They will then go back on to the market and sell the property, charging you a fee for their services. They also hope to profit on your sale by offering you something a little bit less than the market value on the open market.

The attraction for a seller is that an iBuyer will give you a cash offer on your home and close very quickly. You will avoid some of the common home selling obstacles such as marketing your home, going through a buyer’s rigorous home inspection, waiting on their financing, and then hope nothing happens to the sale by closing.

There are, however, some disadvantages to iBuyers as well. An iBuyer’s fees are higher than what a traditional real estate agent would charge. You can expect to pay somewhere between 7-9% commission to an iBuyer. You can’t expect to get top dollar with an iBuyer either as they will be looking to turn a profit from your sale.

Due to the Coronavirus pandemic, most of the iBuyer companies have put a freeze on buying homes. There is no doubt in my mind, however, that they’ll be back in full force once the real estate markets settle back into something healthy. The iBuyer concept is an excellent one for a segment of the home selling public.

House Flippers

House flippers are investors who are looking for a bargain so that they can renovate and sell at a profit. They will be interested in a good deal to maximize their earnings from your house. House flippers come in all shapes and sizes, from large to small investors. You are probably familiar with some of the largest real estate investors either by getting a piece of mail, seeing an advertisement on television, or even on a local telephone pole.

Two of the most prominent house flipping companies are “We Buy Houses” and “We Buy Ugly Houses.” You can read about the pros and cons of We Buy Ugly Houses but essential they are broken down as follows:

PROS

It is super easy to complete a sale.

You’ll get a cash offer.

You will be able to close very quickly.

You will avoid paying a real estate commission.

There will be no real estate agent to deal with.

You call sell no matter what shape your house is in.

You’ll be able to avoid selling by owner.

CONS

You will be selling your property significantly below what it’s worth.

There is no option to make improvements to increase what you’ll net from the sale.

The difference between an iBuyer and a house flipper is that an iBuyer will be looking to purchase properties in excellent shape, while flippers focus on homes that need work.

Rental Investors

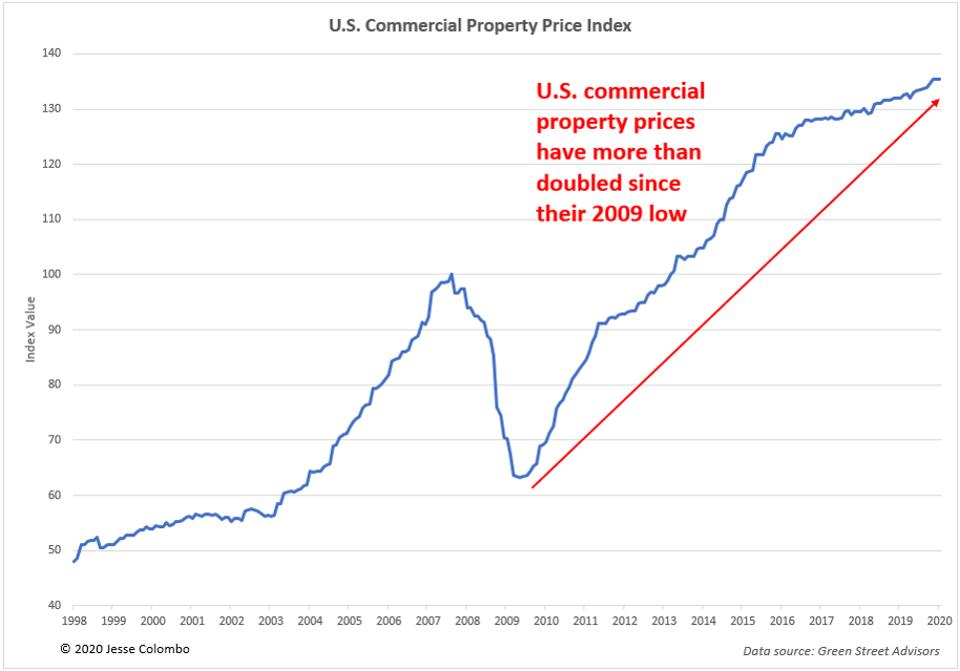

The third type of real estate investor is one who has a “buy and hold” approach. Some cash buyers might be looking to hold onto a property for longer, renting the home out to make their earnings. They will also benefit from the appreciation of the property’s value over this time. These types of cash investors don’t mind being a landlord.

Benefits and Risks of Selling to a Cash Real Estate Investor

There are some benefits and risks to taking the selling home for cash route, let’s take a look at some of the things you should be aware of. Cash is king, so you’ll find having a home sale without a financing contingency is a fantastic place to be.

Financing

One of the things which frequently slows down a home sale is the buyer’s financing. People can find that the mortgage they thought was available from their lender doesn’t get approved when they need it. There could be several reasons for this, but if you have a cash buyer, it isn’t going to be a hurdle you have to face. They’ll be no worrying that a buyer’s bad credit will stop the home sale at the last minute.

As-Is Buyers

When your home needs repairs, it can be more challenging to sell. For many cash buyers, however, this isn’t going to be a problem that will put them off. If the buyer is planning to flip the property, they are looking for homes to renovate anyway.

They will offer a lower price for your home, but it should mean that the sale moves to closing faster. Flippers are likely to be happy with a more problematic home than iBuyers, as they are going to gut it anyway. If your home has some repair issues, an as-is sale can help you avoid having to find the money to pay for repairs, though you will be offered less.

Whether you have a fixer-upper or a complete rehab home, either one will be perfect for a cash investor looking to flip.

Faster Sales

If you have a cash buyer, it could mean you don’t need to bother with things related to listing the home. You won’t need a photographer; there won’t be a bunch of people inconveniently walking through your home, or wasted time doing open houses – (one of the most useless marketing activities for a seller.) Lastly, and most importantly, you are unlikely to need to organize doing any repairs, either.

You can contact a cash buying investor and sell it to them quickly, with the minimum of work on your part.

Contingencies

House purchase contracts usually feature many contingencies, so that buyers can exit the deal if something goes wrong. These mainly protect buyers and could make selling your home a longer process than you would first expect.

When you sell for cash, this is mostly something you will avoid. The buyer may still want to have a home inspection and a contingency related to it, however. Many times they don’t, though.

Other Options

If you are considering whether to sell to a cash buyer, there are other options to think about. You could rent out your home if it is in a reasonable condition. This should cover your mortgage payments even when additional costs like hiring a property manager are considered.

Another possibility is a lease-to-own agreement. This allows you to keep up with the mortgage payments and will provide more money upfront from the tenant to allow them to buy later.

Be Aware of Scams

Whichever option you choose to sell your home, you could be targeted by criminals. A lot of money is involved in house sales, and this attracts criminals intent in scamming you.

Cash buying investors aren’t licensed, and though there are many legitimate businesses, you have to be cautious and do your research. Avoid businesses asking for money to apply, and check your credit report to make sure someone hasn’t taken out another mortgage on your property.

Selling to an investor has many advantages, including reduced stress and complications. It isn’t entirely without its problems, though, and you are likely to get more for your home through a traditional sale.

What’s The Process For a Cash Sale?

If you are selling your home for cash, you probably want to know how it is different than a non-cash sale. Here are the steps for getting to the closing:

Sign the contract – if you don’t have a real estate agent representing you, make sure you have an attorney review it before signing.

Hire an attorney to handle the escrow funds.

Go through the home inspection if there is one.

Get a copy of the HUD settlement statement before closing that details the financials in the transaction.

Load all of your things onto the moving truck and vacate the home.

Review and sign all of the closing papers.

Provide the buyer with a new deed for the property.

Recording of the deed at the local registry.

Final Thoughts on Selling to a Cash Investor

Without a doubt, selling your home to a cash investor eliminates many of the headaches found in a typical real estate transaction. There are, however, downsides like getting far less money out of your sale. Only you can decide whether it makes sense or not to sell to an investor.